Oriental Bank of Commerce Home Loan Apply for Housing Loan Online at Low Interest Rate

Table of Content

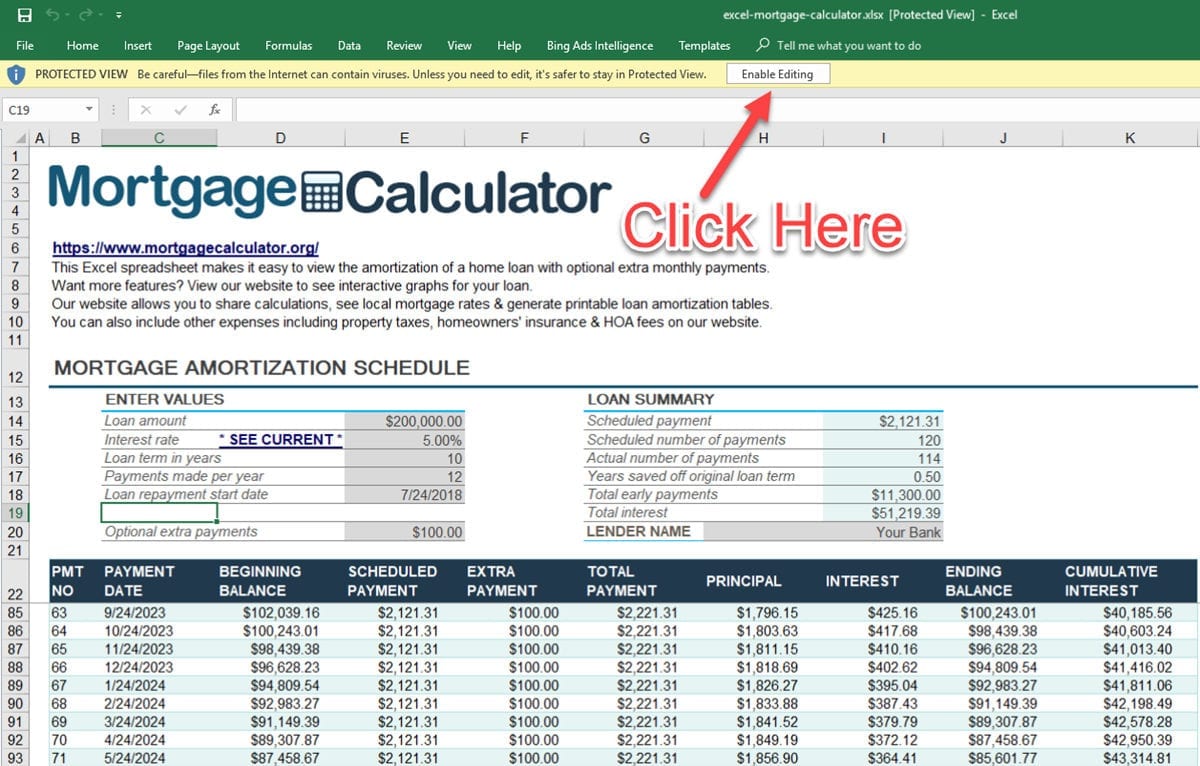

Consider using the Home Loan EMI Calculator provided by BankBazaar to ascertain the EMIs that would be needed to be paid. All you need to do in order to find the payable EMI is enter details like the loan amount, tenure, interest rate, processing fee, etc. and click the ‘Calculate’ button. When it comes to meet your personal expenses, the name of Oriental Bank of Commerce stands taller in the list of personal loan seekers.

APRs are commonly used within the home or car-buying contexts and are slightly different from typical interest rates in that certain fees can be packaged into them. For instance, administrative fees that are usually due when buying new cars are typically rolled into the financing of the loan instead of paid upfront. APR is a more accurate representation than the interest rate when shopping and comparing similar competing. On the other hand, annual percentage yield is the interest rate that is earned at a financial institution, usually from a savings account or Certificate of Deposit (in the U.S.).

INVESTMENT DETAILS PROVIDED BY YOU

You can pay the borrowed loan amount with the applicable interest rate in equated monthly loan installments . You can use the OBC home loan calculator for calculating your loan installments. Read this article and know about the EMI calculator device and its benefits.

The amount of his liability will be the same as that of the principal borrower and the Bank can take strict actions against him for recovery along with the principal borrower. Guarantor can’t say that his liability will start only after the remedies against the principal borrower are exhausted. Home Loan Interest Rate is linked to PLR, and any change in PLR will lead to a change in rates of interest on the home loan. Interest rates on home loan account will rise or fall with the increase or decrease of PLR, proportionately. A year after the disbursement of the existing loan amount and the possession or completion of the financed property. Before accepting the loan, the bank verifies the property records.

Oriental Bank of Commerce Home Extension Loans – For Adding Space in Your Home

Without filling and submitting the form, it is not possible for you to avail the loan. The mandatory fields which are required to fill in the form are-Name, Age, Gender, Marital Status, Work Experience, Employment Type, etc. In the U.S., credit scores and credit reports exist to provide information about each borrower so that lenders can assess risk. A credit score is a number between 300 and 850 that represents a borrower's creditworthiness; the higher, the better.

Households in the Middle Income Group-II have an annual income of between 12,00,001 and 18 lakh rupees. Specific Information for Home Improvement Loan SchemeEligible ProfilesAvailable to Salaried and Sef-employed IndividualsLoan AmountNew Customer – Up to 90% of the estimates from improvements. This type of loan is specially established for EWS/LIG, families under MIG-I, and MIG -II categories. The validity of this scheme is up to 31 march 2022 (EWS/LIG), 31 march 2021 (Families under MIG-I and MIG -II categories).

Oriental Bank Commerce Home Loan Customer Care

The processing fee applicable is 0.35% of the loan amount plus GST. EWS, LIG, and MIG applicants can enjoy subsidised rates under the PMAY scheme through PNB. At what rate does Oriental Bank of Commerce charge a processing fee for personal loans? OBC charges a processing fee of 0.50% of the loan amount with a minimum of Rs.500 along with Service Tax. Example – If you have taken a personal loan of Rs.2.5 lakh from OBC at an interest rate of 13.76% p.a., you will be charged a processing fee of 1%. Based on this, the loan repayment details for different tenures are as indicated above.

BankBazaar’s Personal Loan EMI Calculator is an online tool that can be used universally to calculate the installment amount towards a personal loan from OBC. The tool also gives a total breakup of all charges included in the loan. The calculator makes use of the repayment table to generate an instant output. Planning to avail a home loan from Punjab National Bank?

Secured loans—Generally speaking, unsecured loans will carry higher interest rates than secured loans, mainly because there is no collateral involved. That is, if the borrower defaults, the lender is legally entitled to ownership of the collateral. Borrowers seeking more favorable interest rates can consider putting up collateral for a secured loan instead.

At the branch office, you can also get all your queries and doubts answered by the representatives. In case of salaried professionals, there has to be proof that they were in employment for a minimum period of two or three years in total and minimum one year at their current workplace. The loan amount is offered to purchase durable consumer items like laptops, refrigerators, air conditioners, etc. If you are purchasing a plot of land to build your house on or a already built up or a semi built house. OBC’s home loan can also be used for repairs and renovations around your house.

However, several people are unable to obtain the amount of home loan they need. Any borrowers are turned down because they do not fulfil the loan eligibility requirements set out by different lenders. This is where bringing in a co-applicant will save the day. Including a co-applicant will also provide you with potential advantages.

I further authorize Wishfin to obtain such information solely to confirm my identity and display my Consumer Credit Information to me. Absolutely, afinoz.com loan calculator tools are completely free and we are not charging any fee for the services we provide. In case there is a guarantor or a co-applicant, the above documents list will apply to them too.

Some of the housing loans offered are – PNB Max Saver, PNB Gen-Next Housing Finance, PNB Pride Housing loan. The bank offers home loan in excess of Rs.75 lakh at attractive interest rates. If you are interested in applying for a personal loan, need not to worry as all you need to do is simply fill the required application form. Yes, an application form is a mandatory thing which an applicant needs to fill and submit the duly signed.

You would be glad to know that founded in Lahore, the New Delhi-headquartered public lender is a home to a gamut of best-in-class products like personal loan to address your fund requirements. Be it pensioners, employees of public sector & private sector units or home loan borrowers, the bank has attuned its personal loan schemes for each one of them. Special offers, interest rates & nominal charges for oriental bank of commerce account holders. Individuals applying for OBC personal loan should pay attention towards documentation required to get the personal loan in Oriental bank of commerce. During the time of loan application, the applicant must have completed 18 years of age. There are two different maximum ages for the applicant, depending on whether the applicant has a pension or not.

Comments

Post a Comment