OBC Personal Loan EMI Calculator Calculate your EMI in 2 Mins

Table of Content

With the help of this device, you can any time, anywhere know the exact amount of your EMIs that you need to give to your lender each month so that your personal loan can be repaid. In Jan 2017 I was looking for Personal Loan from OBC and was very confused before I checked the website of Afinoz. The website gave me all the important information about the loan schemes of OBC Personal Loan as per my requirements. Depending on the loan amount, eligibility of the applicant, a guarantor may be required. The Oriental Bank of Commerce requires the guarantor to be a co-employee of the applicant, and the same cannot stand as guarantor for more than two accounts. You can apply for the loan by visiting a branch near you, or you can do it online too.

Larger financial institutions The State Bank of India and HDFC are now providing home loans worth more than Rs 75 lakh with a term of up to 15 years. Interest rates are charged on a daily balance method and are debited once a month in your loan account. A 2% penalty on the unpaid Installment amount will be charged. Dialabank is a bridge to find the best option between several Banks and NBFCs by providing you with a detailed and structured market comparison of different banks.

Flipkart Axis Bank Credit Card Can Make Your Stay Home Payments Easy!

As there are multiple calculations involved in selecting the right loan for you, this online tool is ideal. Loan tenure chosen and processing fee charged by the bank. I have several problem earlier with this bank but now i am fine .

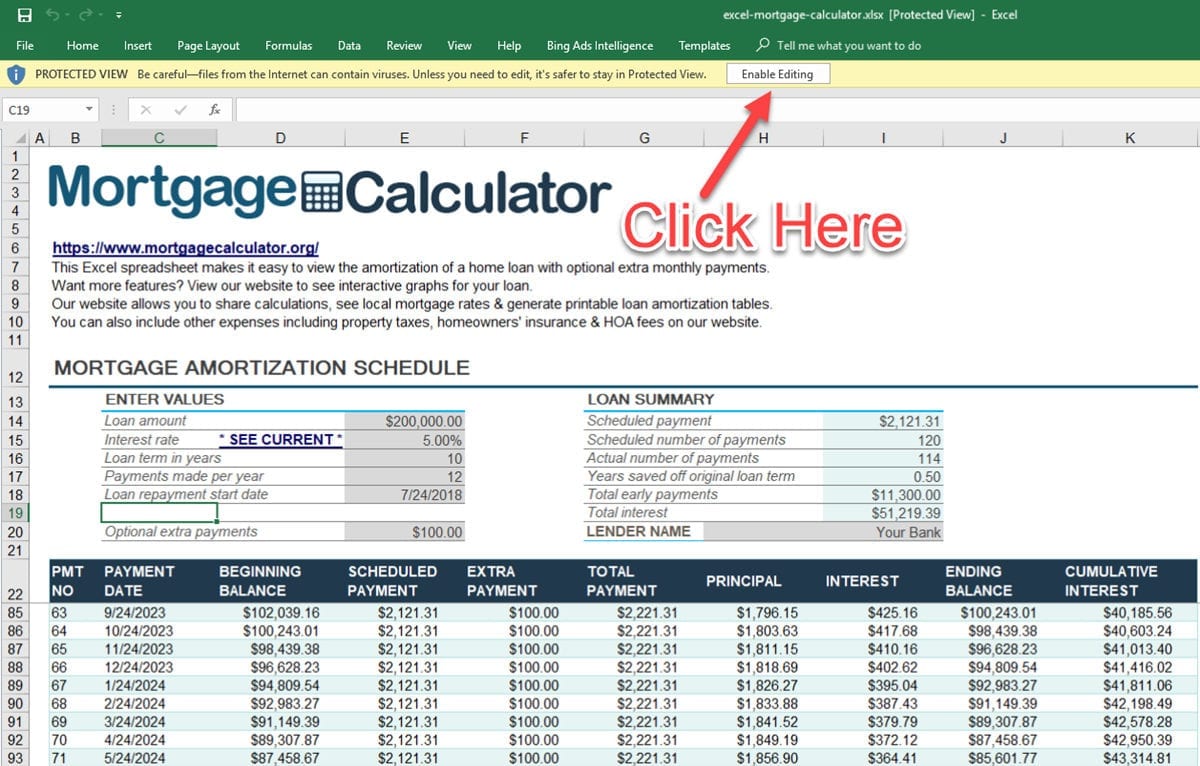

The bank, in turn, offers the loan at an interest rate of 8.45% per annum. EMI, an abbreviated form of Equated Monthly Installment, is a sum of interest and principal amount payable every month till the expiry of the home loan tenure. So when you sit to compute the EMI using the calculator, all you need then is to enter the loan amount, interest rate and the tenure.

Loan Amount (max)

Purchase a flat, row house, bungalow in India from private developers in approved projects. Please find more information on Eligibility by visiting Dialabank. I have read the Privacy Policy & Agree to Terms & Conditions and authorize Dialabank & its partner institutions to Call or SMS me with reference to my application. Find if your money habits will ensure a healthy financial life or not.

You can visit your nearest OBC bank branch or can apply for a home loan through its online banking service. Just submit some documents to the bank like ID proof Aadhaar Card, Pan Card, etc. and income proof such as bank statement, salary slip and income tax return report . So, finance your property or renovate if your house if you haven’t done for a long and construct a house using the OBC home loans. And for any assistance during the home loan procedure, you can use the OBC home loan EMI calculator and manage your home loans without any trouble.

Interest Rates by Banks

Although individual credit standing is one of the most important determinants of the favorability of the interest rates borrowers receive, there are other considerations they can take note of. In most developed countries today, interest rates fluctuate mainly due to monetary policy set by central banks. The control of inflation is the major subject of monetary policies. Inflation is defined as the general increase in the price of goods and services and the fall in the purchasing power of money. It is closely related to interest rates on a macroeconomic level, and large-scale changes in either will have an effect on the other.

All you have to do is change the data and the calculator will do its job automatically. Speed of Calculation – Using the online calculator, you can determine the EMI amount in seconds, rather than manually calculating for hours. This efficient system allows you to explore various loan tenure options, interest rates, and loan amounts to arrive at a suitable EMI. I have closed the loan before 4 years, the documentation process was simple and no hassle faced. The rate interest was simple interest of 5%, I got loan amount in one shot. After knowing the eligibility, it is also important for you to know the EMIs of the loan amount as well.

How To Apply for Oriental Bank of Commerce Home Loan

The applicant must be between the age group of 18 years to 65 years. We'll ensure you're the very first to know the moment rates change. A GST rate of 18% will be applicable on banking services and products from 01 July, 2017. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

The loan can be paid off through remittances done from their foreign country or use the sales process of immovable property. Much of the eligibility criteria to avail a house loan for an Indian resident is the same for an NRI or POI. It will depend on the income and the financial history of the applicant. The maximum permissible loan amount will be calculated based on the income of the individual and also of the co-applicant. In case there is more than one owner of a property piece, the income of the joint owner will be considered.

In the U.S., the Federal Reserve can change the rate at most up to eight times a year during the Federal Open Market Committee meetings. In general, one of their main goals is to maintain steady inflation . Simple interest is calculated as a percentage of principal only, while compound interest is calculated as a percentage of the principal along with any accrued interest. As a result of this compounding behavior, interest earned by lenders subsequently earns interest over time. The more frequently interest compounds within a given time period, the more interest will be accrued.

The borrower will learn the actual loan sum that the bank will accept and the interest rate that paid over different terms. The bank sends you an official authorization letter stating that your loan has been authorized, including this information. OBC provides a variety of home loan options with low interest rates. Before applying for a home loan, you must, however, compare various banks and their deals.

Secured loans—Generally speaking, unsecured loans will carry higher interest rates than secured loans, mainly because there is no collateral involved. That is, if the borrower defaults, the lender is legally entitled to ownership of the collateral. Borrowers seeking more favorable interest rates can consider putting up collateral for a secured loan instead.

The applicant can also make the payment through the sale process of immovable properties. The maximum age limit of the applicant, if they are salaried and a pensioner is 70 years. The maximum age limit of the applicant, if they are salaried and have no pension, is 60 years. OBC allows for their home loans to be applied to by non-resident Indians and also by Person of Indian Origin .

Comments

Post a Comment